|

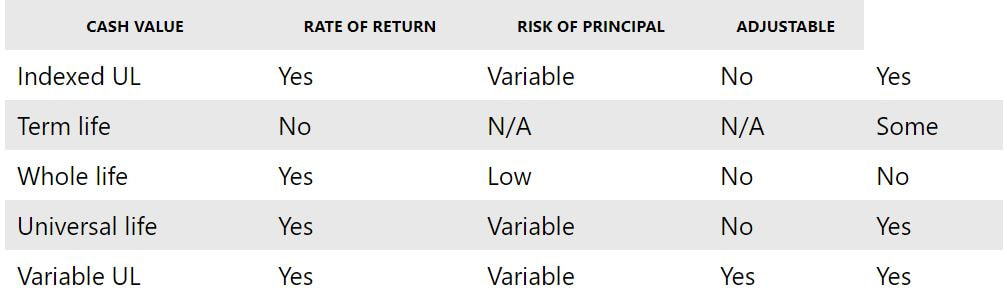

In a nutshell, an indexed universal life insurance policy (IUL) is a form of universal life insurance that pays interest based on the performance of a financial index chosen by your insurer, such as the S&P 500 stock market. The term of this type of policy is divided into crediting periods, also called index periods, which typically range from one month to two years. When the index rises during a given crediting period, the insurance company will credit your policy's cash value with a corresponding amount of interest rather than a fixed interest rate. Indexed universal life insurance policies also normally provide an interest rate guarantee. Those who use the longest crediting periods usually earn the most interest. In most cases, the amount of interest that you can earn during a given crediting period is limited, just like it is with indexed annuities. These limits come in three forms: A "cap" – This is an absolute limit on the amount of interest that is paid. For example, if the benchmark index rises by 30% during a given crediting period, then you may only be able to receive 10% of the growth. The insurance company will keep the difference. A "spread" – This is an amount that the insurance company takes off the top during every crediting period. If the index rises by five percent during a crediting period and your policy has a spread of two percent, then the insurer keeps the first two percent and lets you take the remaining three percent. A "par" rate – This is a participation rate that is a percentage of the growth of the index. If your policy has an 80% par rate, then you will be credited with interest equal to 80% of the growth of the index during that crediting period. Indexed universal life insurance has the same premium and death benefit flexibilities that are found in standard universal life policies. Monthly premiums are adjustable and generally decrease over time as your cash value account increases. Death benefits are also flexible and often have the ability to be lowered or raised at any time. Though your IUL cash value can be accessed freely, it is recommended that this is done with caution as doing so could result in reducing your death benefit or lapsing your account. Who needs indexed universal life insurance? Anyone who is looking for a long-term or permanent life insurance policy, which has the potential to grow cash value at a faster rate than other whole or universal life policies, is a prime candidate for an IUL. Policyholders earn interest at a variable rate and can earn a higher average rate of return over time without risking their money in the stock markets. Indexed universal life insurance vs. other types of life insurance The following table illustrates the similarities and differences between indexed universal life insurance compared with other types of life insurance policies: Indexed universal life insurance resembles traditional universal life insurance more than any other type of policy. The main difference involves how interest in the cash value is generated. IULs generally have an edge over regular ULs when it comes to overall rate of return, at about 1.5-2% more on average.

Pros and cons of indexed universal life insurance Pros Cash value accumulation Indexed universal life insurance policies have a cash value component which is the part of the policy that is available to you for use while you're still alive. You can use it for anything you want from sending your kids to college to taking a vacation. However, be careful because if you don't pay it all back it can impact the death benefit left to your loved ones. If you don't deplete your cash value by withdrawing from it then this amount (in addition to your death benefit) will be left to your beneficiaries when you die. Tax-free withdrawals The best part about taking money from your cash value? You don't have to pay taxes on it. This is because you've already paid income tax on the money before you've contributed it to your life insurance policy – so you won't have to pay taxes on it again. Adjustable premiums and death benefits Your premiums will adjust over the life of your policy based on the amount of money that's in your cash value component. This allows you to save some money in the long run. Cons Expense Indexed universal life insurance is expensive – in fact, it's one of the most expensive life insurance types out there. It's definitely more expensive than a term policy and so it may be worth considering a more affordable investment option. Variable Interest Rates Your interest rates will vary based on how your money is invested. As the indexes go up, the interest you earn will rise. However, that means that the interest you're earning can go down – or disappear altogether. You're at the mercy of the stock market with this kind of policy. Source: money.msn.com

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

February 2022

Categories |

USA Mutual Insurance Agency, LLC | 4830 Arthur Kill Road, LL1 Staten Island, NY 10309 | (718) 285-6500 | [email protected]

RSS Feed

RSS Feed