|

What is level term insurance? There are multiple types of term life insurance policies. Rather than covering you for your entire lifespan like whole life or universal life policies, term life insurance only covers you for a designated period of time. Policy terms generally range from 10 years to 30 or more years, although shorter and longer terms may be available. Level term life insurance policies maintain the same death benefit level and premium level over the life of the policy. When applying for a policy, you will specify and list your chosen beneficiaries. You will also select an amount for the death benefit and a length for the policy - for example, you may choose a 10-year term with a $100,000 death benefit. If you pass away during the policy term, your beneficiaries receive the death benefit from the policy. Types of level term insurance Level term life insurance generally comes with one of several policy term options:

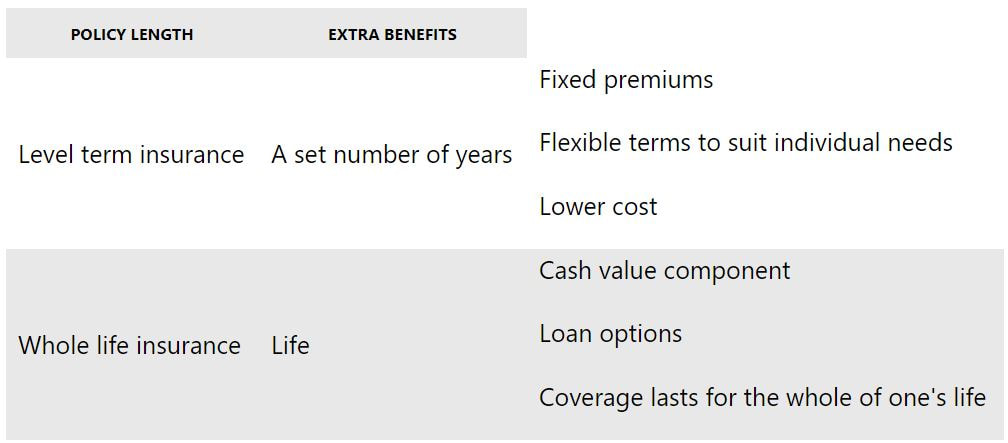

Level term versus whole life insurance Whole life is a type of permanent life insurance, meaning that the policy lasts for a person’s lifetime. Term life only lasts for a set length of time, determined when the policy is written. Another key difference is that whole life policies include a cash value investment component while term life does not. Who needs level term life insurance?

Choosing the right insurance can be tricky. Term life insurance is often recommended over other life insurance types for those who are less experienced with life insurance in general. Part of this may be due to the simplicity and relative cheapness of term life compared to permanent life policies. As a result, people interested in buying life insurance but who are unfamiliar with its nuances might consider starting with term life. Many people choose to purchase level term life insurance when they know they are entering a financially significant time in their lives. People taking out mortgages may decide to buy a term policy that lasts until their mortgage is paid off. People with children going into expensive schools may take out a policy to last until their children are expected to graduate. In general, level term life policies can benefit those entering a period where their loved ones would be disproportionately financially affected by their death. This can span many different scenarios, but the goal of purchasing level term life insurance is to provide compensation for the financial loss associated with the policyholder's passing. What is the cost of level term life insurance? How much is term life insurance? Many factors go into determining the rates on a level term life insurance policy. Two of the most important factors are the term length of the policy and the death benefit amount. Age is another significant component. The older a person is, the more expensive a life insurance policy is likely to be. Health works in a similar way to age. Those who struggle with their health will likely pay higher premiums than those who do not experience health issues. Males are generally more expensive to insure than females. This is partly because women, on average, live longer than men. Risky behaviors may also contribute to policy premiums or may exclude you from coverage. Source: MSN Money

0 Comments

|

Archives

February 2022

Categories |

USA Mutual Insurance Agency, LLC | 4830 Arthur Kill Road, LL1 Staten Island, NY 10309 | (718) 285-6500 | [email protected]

RSS Feed

RSS Feed